What Millennials Want: The Future of Millennials in the Credit Union System, a new report from the Filene Research Institute, reveals how millennials perceive credit unions compared to commercial banks. For the past 25 years, The Filene Research Institute has been a non-profit, independent think tank for the consumer finance industry. A summary of the findings and their significance is explored by University of Wisconsin Law School Lecturer Andrew Turner in this article:

In a competitive marketplace, attracting the youngest generation is not just good business; it’s a survival imperative. Millennials 18–24 years old have been a key focus for credit unions over the last 10 years—and for good reason: There are nearly 71 million millennials, born between the late 1970s and early 1990s, in the United States today. The potential for credit unions to capture a significant market share of this demographic is pretty high by even the most conservative estimates or projections. And yet, the flood of new members has never really happened.

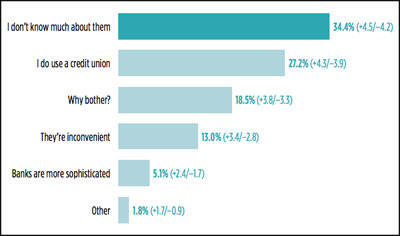

Why, then, have credit unions struggled in capturing the hearts and minds of millennials throughout the last decade? After all, the financial meltdown of 2008 should have been the turning point for credit unions to overtake banks as the primary financial institution of choice for young adults. The stigma of the word “banks” should have been enough to drive millennials toward credit unions. Do the youngest millennials understand the credit union concept as well as their parents and grandparents do?

This study addresses what has been done and what can be done to help the youngest millennials—particularly the 18- to 24‑year-olds—better understand the credit union system and the principles it operates on. Using a mix of primary research and literature review, we were able to create a foundational study that outlines how 18- to 24‑year-olds currently perceive credit unions, whether they differentiate between banks and credit unions, and whether credit union characteristics such as nonprofit status and member governance matter to them.

The study suggests strategies that are worth considering:

Technology isn’t enough to impress.

Social media is crucial for engagement

Focusing on price will cost you the game

Many young millennials are unaware of the core principles of the credit union system. Credit unions can capture this young demographic by providing them with personalized products of great need and relevance.

Filene thanks our generous supporters for making this important research possible.